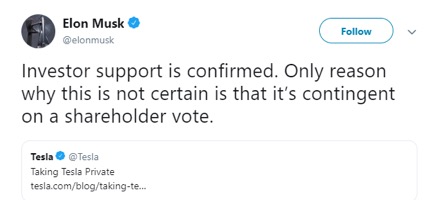

Theodore O’Brien – On August 7, 2018, Elon Musk, the talented, puzzling CEO of Tesla Motors, rocked the business world with two simple tweets. In his first message, Musk shared, “Am considering taking Tesla private at $420. Funding secured.” Later that day, he followed that tweet with another: “Investor support is confirmed. Only reason why this is not certain is that it’s contingent on a shareholder vote.” Word of Tesla going private unsurprisingly boosted Tesla’s share price, closing the day up eleven percent.

The surging stock price was welcome news for Musk, who had been waging a war against the “shorts” for years. (Shorts, by way of background, refers to those investors who bet against Tesla by borrowing the company’s stock and immediately selling those shares, hoping to buy back and return the borrowed shares once Tesla’s stock price declines.) The stock price high was short-lived, however, as it soon became clear that Tesla was nowhere close to a take-private deal. Even if Musk somehow secured funding, it was far from certain that Tesla’s board members—many of whom were reportedly “surprised” by Musk’s tweet—would approve such a deal. For the shorts, however, the damage was done. The tweet cost shorts an estimated $1.3 billion.

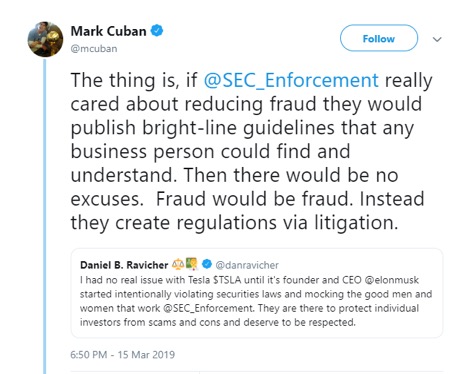

The tweet also cost Musk, though: the Securities and Exchange Commission (SEC) investigated Musk and sued the CEO for making “a series of false and misleading statements” declaring that he had secured financing when “[i]n truth and in fact, Musk had not even discussed, much less confirmed, key deal terms, including price, with any potential funding source.” The complaint further alleged that Musk’s “public statements and omissions caused significant confusion and disruption in the market for Tesla’s stock and resulting harm to investors.” Musk and the SEC ultimately reached a settlement wherein Musk stepped down as chairman of Tesla’s board, and both Musk and Tesla paid $20 million each in fines. But in March 2019, months after the settlement, the SEC filed a motion with a federal judge seeking a contempt order against Musk for violating the settlement conditions with yet another ill-advised and unapproved tweet. As the debate between billionaire investor Mark Cuban and UMBLR’s own faculty advisor, Professor Daniel Ravicher, shows, the SEC suit and contempt motion over a tweet is controversial.

Whatever the merits of the regulator’s actions, the real threat to Musk may not be from the SEC, but from Tesla’s shareholders. Shortly after Musk’s August 2018 tweets, shareholders filed suits against the CEO alleging that they had been harmed by the misleading tweets. One lawsuit, filed on behalf of institutional investors, accuses Tesla’s CEO and directors of breaching their fiduciary duties to shareholders. On September 6, 2018, prominent short Andrew Left filed a federal class action suit against Tesla and Musk, accusing the defendants of violating the Exchange Act and SEC Rule 10b-5 by “artificially manipulate[ing] the price of Tesla securities with objectively false tweets in order to ‘burn’ the Company’s short-sellers.” See Complaint at 5. As the Left complaint detailed, the class includes all shareholders because, while the stock’s initial pop “burned” short sellers, the stock fell soon after when investors learned Musk had misstated the truth about a possible going-private transaction. See Complaint at 9-14. Angry short sellers didn’t have to look hard for evidence suggesting Musk’s tweet was a concerted effort to “squeeze” the shorts. The CEO hasn’t been subtle in sharing his disdain for shorts that bet against Tesla. Take, for example, Musk’s tweet warning shorts to exit their trades before their positions “explode[]”:

In early October of 2018, Musk launched into a “tweet storm” for twenty hours, railing against short sellers, lenders to short sellers, and the SEC (or the Shortseller Enrichment Commission, as Musk put it). In a more humorous example of Musk’s battle with the shorts, famed short seller David Einhorn received a pair of short shorts from Tesla’s CEO—only a few days after the take-private tweets. But Tesla shareholders aren’t laughing. They are moving forward with a class action against the CEO, claiming that Musk’s take-private tweet was designed to hurt short sellers by artificially pumping up the stock price.

Many—if not all— of the shareholder suits have since been consolidated. U.S. District Judge Edward Chen selected Glen Littleton, an investor claiming losses of $3.5 million, to serve as lead plaintiff in the class action. Littleton held a mix of long and short interests in Tesla, a fitting balance given that the complaint alleges harm to all Tesla shareholders, not just the shorts. The suit alleges that the confusing and misleading series of public statements ended up hurting long Tesla shareholders because the stock fell when the take-private deal failed to materialize and the SEC began its inquiry. Judge Chen summarized the alleged injuries to short and long investors in his order:

Those who took long positions were injured when, e.g., they purchased Tesla securities after the alleged fraud (i.e., when the price of the securities was artificially inflated) and then sold after the truth began to be disclosed. Those who took short positions were injured when, e.g., they covered their short positions by purchasing Tesla securities after the alleged fraud (again, when the price of the securities was artificially inflated).

One of the class members, Bridgestone Investment Corp., filed an interlocutory appeal to the Ninth Circuit, arguing that Judge Chen erroneously deviated from the Private Securities Litigation Reform Act when he appointed Littleton. Bridgestone argues that, instead, it should have been appointed lead plaintiff because it sustained the greatest losses. Judge Chen paused the proceedings against Tesla and Musk while the Ninth Circuit decides the issue.

Although shareholders disagree on who is the best representative of the class, the plaintiffs agree on one thing: Elon Musk’s tweets and public statements seriously harmed shareholders.